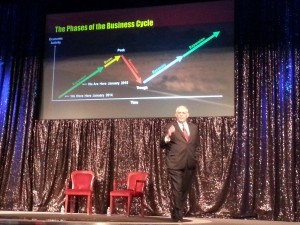

Dieli talks economic growth at Aftermarket Dialogue

by Lucas Deal

January 26, 2015

The underrated recovery continues.

That was the main sentiment from economic forecaster Bob Dieli during the opening session of Heavy Duty Aftermarket Dialogue on Monday in Las Vegas.

Dieli says America’s current economic cycle is proving to be stronger and, most importantly, more stable, than it is getting credit for.

Now 67 months old, he projects the current positive period still has room to grow before reaching its peak. He says bond rates, interest rates and truckable economic activity numbers for the expansion share much more in common with the 1991 to 2001 expansion than the 2001 to 2007 boom.

“Maybe we should stop talking so [poorly] about this recovery,” he says. “It’s about to become the fourth longest in U.S. History.”

According to Dieli, the reasons for encouragement are many.

He says a positive yield inverse curve between ten-year bond rates and personal consumption expenditures price is one big positive. Dieli says every recorded recession has been preceded by a negative yield inverse curve. And even though some negative curves have not turned into recessions, current positive numbers show strong economic stability.

He also says trucking-related job growth is booming, with no slow down in sight. New trucking stagnated then fell in 2007 before the last recession. Conversely, trucking employment up 15.8 percent since early 2010, and Dieli says that growth rate remains stable.

Consistent inflation rates are another positive. Dieli says inflation is the “blood pressure of the economy.” When its too high that’s bad, and when it’s too low, that’s bad.

Dieli says its currently within the safe range at slightly less than 2 percent.

Looking ahead, he places the current recovery in the middle of its expansion period. No longer recovery, but not yet to its peak.